california sales tax payment plan

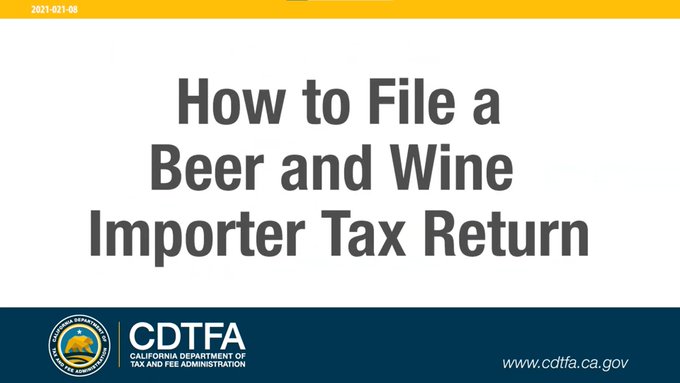

You can find the. State Local and District Sales and Use Tax Return CDTFA-401 PDF General Resale Certificate CDTFA-230 PDF Guides.

Secured Property Taxes Treasurer Tax Collector

Common reasons to change or cancel.

. An additional 10 percent penalty may apply if you do not pay the tax by the. Retailers engaged in business in California must register with the California Department of Tax and Fee Administration CDTFA and pay the states sales tax. Change or cancel a payment plan.

California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19 Effective April 2 2020 qualified small businesses can take advantage of a sales tax. It may take up to 60 days to process your request. The payment plans are in addition to the previous assistance CDTFA has rolled out to small businesses for any taxes and fees administered by CDTFA.

Keep enough money in. Provide an automatic three-month payment extension for taxpayers filing less than 1 million in sales tax on their returns and extend the availability of existing interest and. Sales Use Tax in California.

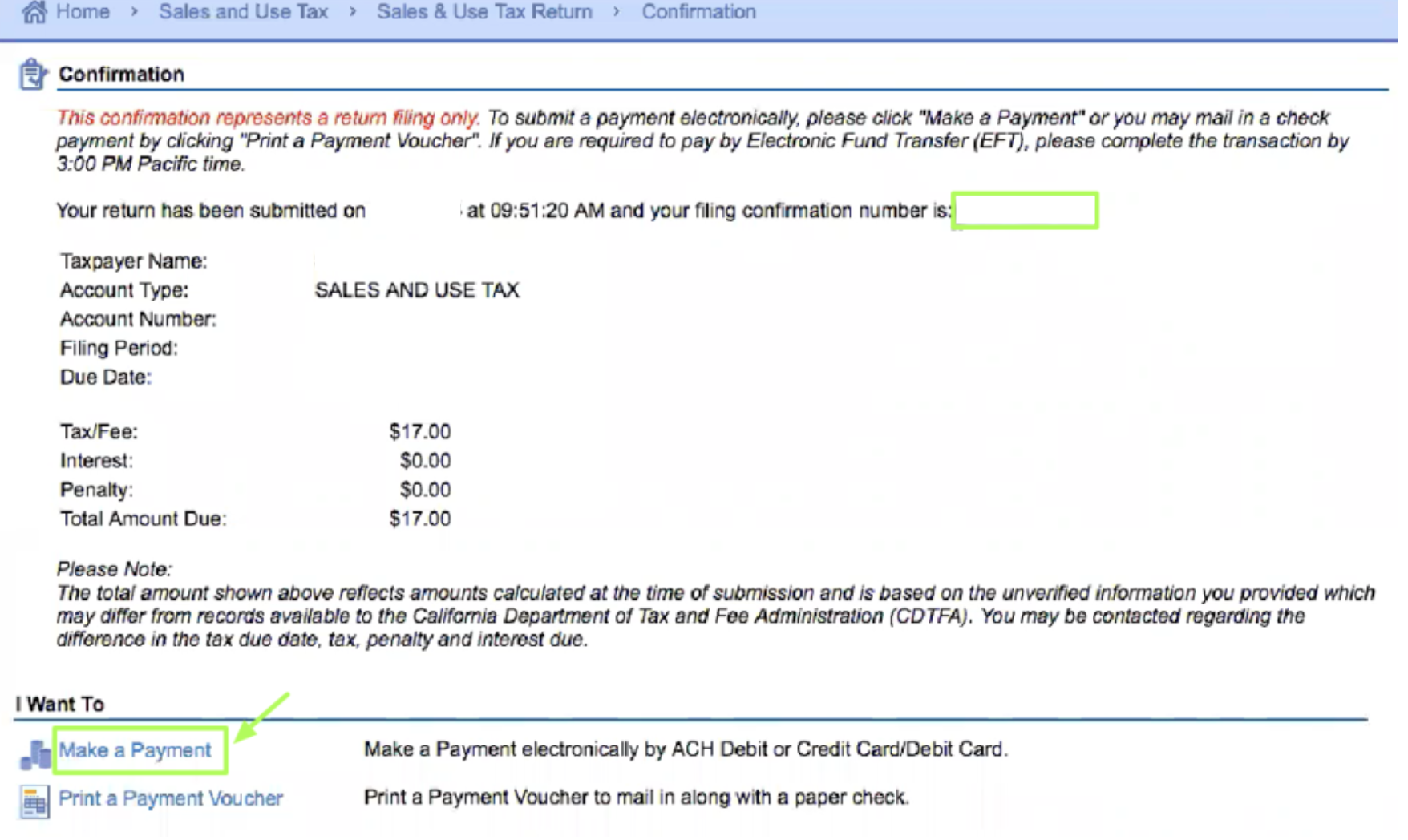

However your total penalty will not exceed 10 percent of the amount of tax for the reporting period. Sales and Use Tax Forms and Publications Basic Forms. Pay by automatic withdrawal from my bank account.

Simplified income payroll sales and use tax information for you and your business. BREAKING NEWS Effective April 2 2020 California is granting small businesses 12 months to gradually remit the sales taxes that they have collected from customers. Write your CDTFA account number on your check or money order.

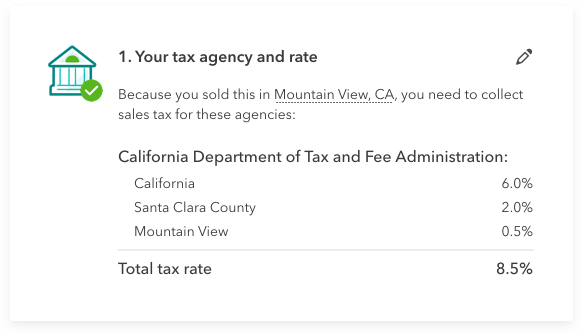

This includes the 600 state sales tax rate and an extra 125 local rate. Effective December 15 2020 small business taxpayers with less than 5 million in taxable annual sales can take advantage of a 12-month interest-free payment plan for up to 50000 of sales. California Announces Sales Tax Payment Plan for Small Businesses due to COVID-19.

Under the payment plan qualifying businesses can enter into a payment plan to distribute. Make your check or money order payable to the California Department of Tax and Fee Administration. A Sellers Permit is issued to business owners and allows them to.

Most retailers even occasional sellers of tangible goods are required to register to collect sales or use tax. For sales and use tax originally due between December 15 2020 and April 30 2021 business taxpayers with less than 5 million in annual taxable sales are eligible for a 12. Make monthly payments until my tax bill is paid in full.

Change your payment amount or. The California sales tax is a minimum of 725. If you cant pay your tax bill in 90 days and want to get on a payment plan you can apply for an installment agreement.

Effective April 2 2020 small businesses with less than 5 million in taxable annual sales can take advantage of an interest- and penalty-free sales tax payment plan being offered. The plans are flexible and allow taxpayers to pay monthly biweekly or weekly. Not only is this the highest base rate in the country but some counties and cities charge even higher rates.

The CDTFA offers payment plans for taxpayers who cannot immediately pay their full amount in arrears. The tax rate for California is 725. Pay a 34 setup fee that will be added to my balance due.

To change your current installment agreement call us at 800 689-4776. There are also various district sales tax rates in California.

Sales Tax Software For Small Business Quickbooks

State Accepts Payment Plan In Folsom Ca 20 20 Tax Resolution

How To File And Pay Sales Tax In California Taxvalet

Irs Franchise Tax Board Department Of Labor Fasb Aicpa Windes

California Sales Tax Small Business Guide Truic

Middle Class Tax Refund Ftb Ca Gov

California Sales Tax Map By County 2022

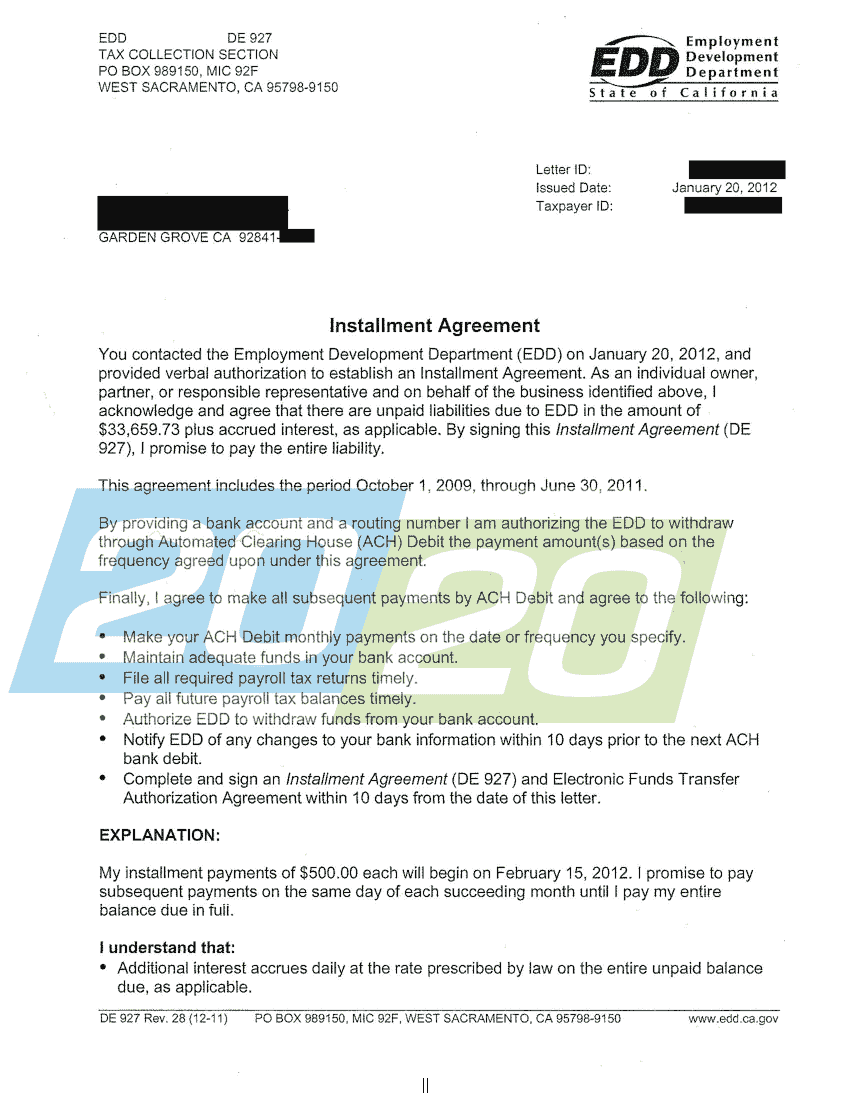

State Accepts Payment Plan In Garden Grove Ca 20 20 Tax Resolution

Cdtfa Ca Department Of Tax And Fee Administration

Marijuana Tax Breakdown For Los Angeles Residents Cornerstone Wellness

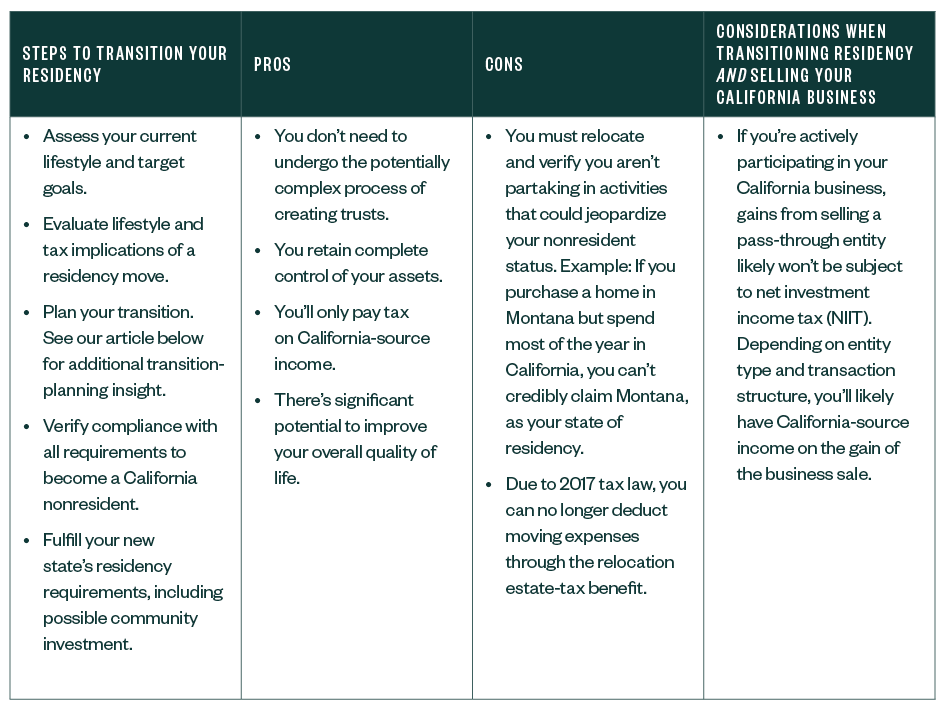

Considerations For Changing Your Residency From California

State Of California Income Tax Rates Youtube

State Accepts Payment Plan In San Jose Ca 20 20 Tax Resolution

How Do State And Local Sales Taxes Work Tax Policy Center

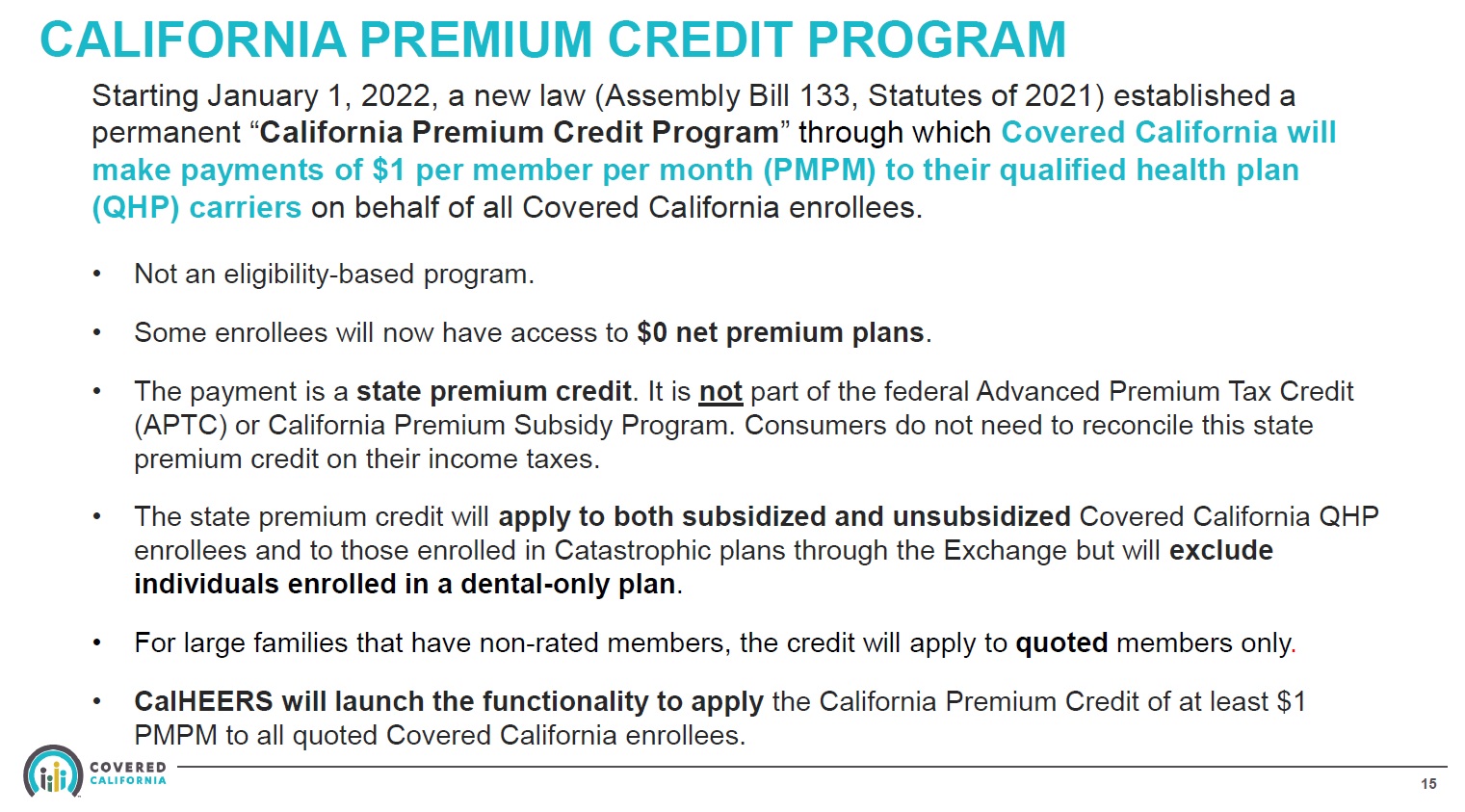

1 Dollar Covered California Member Bonus For 2022